Have you ever struggled with creating a pro forma financial template for your business? It can be a daunting task, especially if you’re not a finance expert. But fear not, we’re here to help simplify the process for you!

Pro forma financial templates are essential tools for forecasting and planning your business’s financial future. They allow you to project your company’s income, expenses, and cash flow, helping you make informed decisions and set realistic goals.

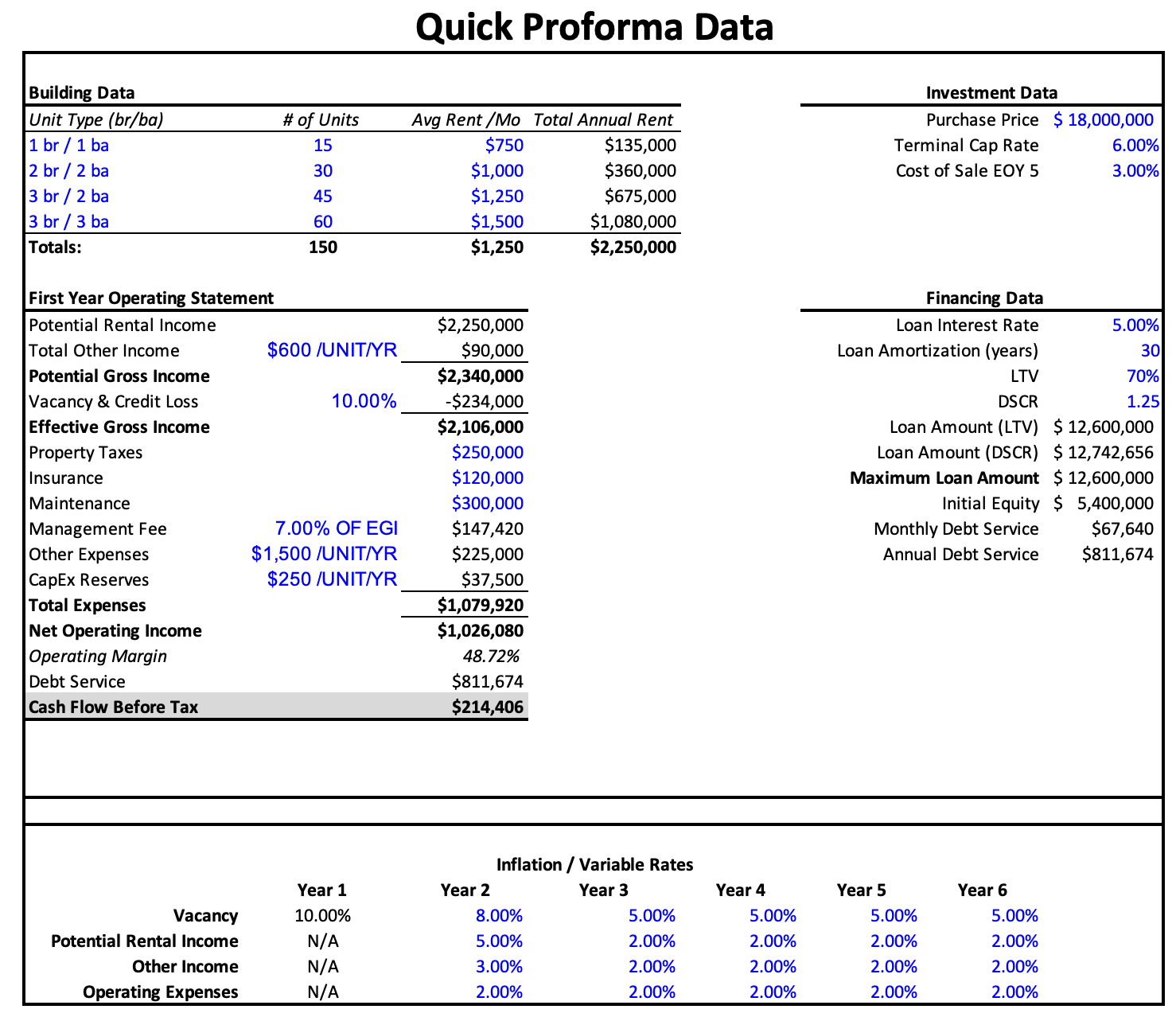

Pro Forma Financial Template

Creating a Pro Forma Financial Template

Start by gathering your historical financial data, such as past sales figures, expenses, and cash flow statements. Use this information to create realistic projections for the coming months or years.

Next, input your projections into a spreadsheet or financial software program. Be sure to include all relevant expenses, such as payroll, rent, utilities, and marketing costs. This will give you a comprehensive view of your financial outlook.

Once your pro forma financial template is complete, review it regularly to track your actual financial performance against your projections. This will help you identify any discrepancies and make adjustments as needed to stay on track.

In conclusion, creating a pro forma financial template doesn’t have to be intimidating. By following these simple steps and staying organized, you can gain valuable insights into your business’s financial health and plan for a successful future.

Learn How To Create A Pro Forma Income Statement To Help To Grow Your Business

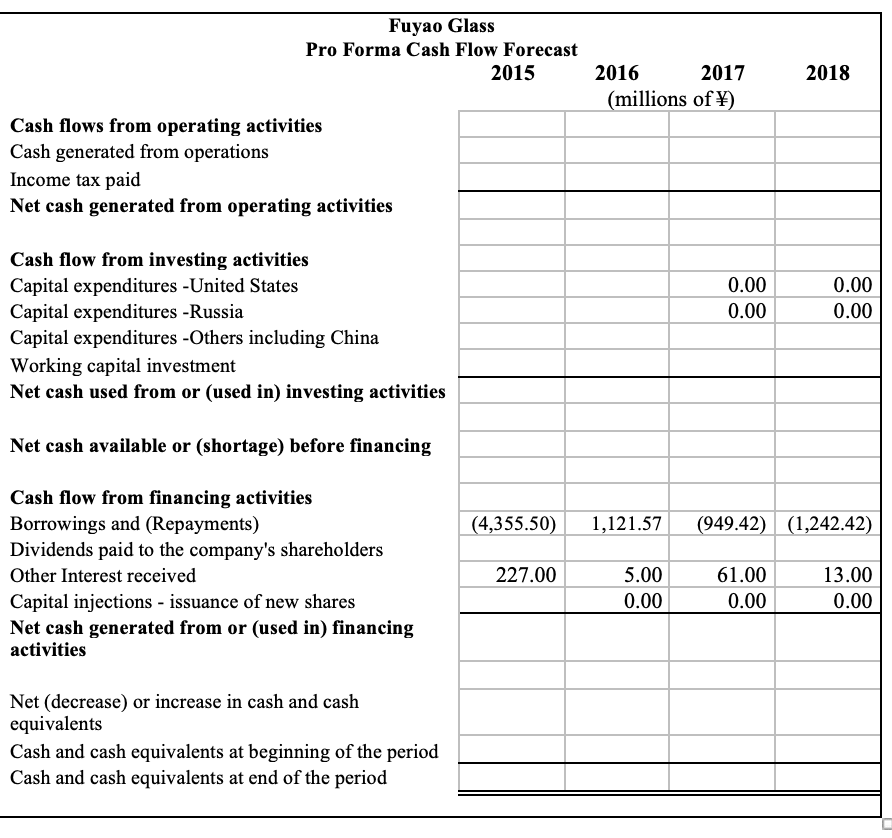

The Pro Forma The Sweaty Startup

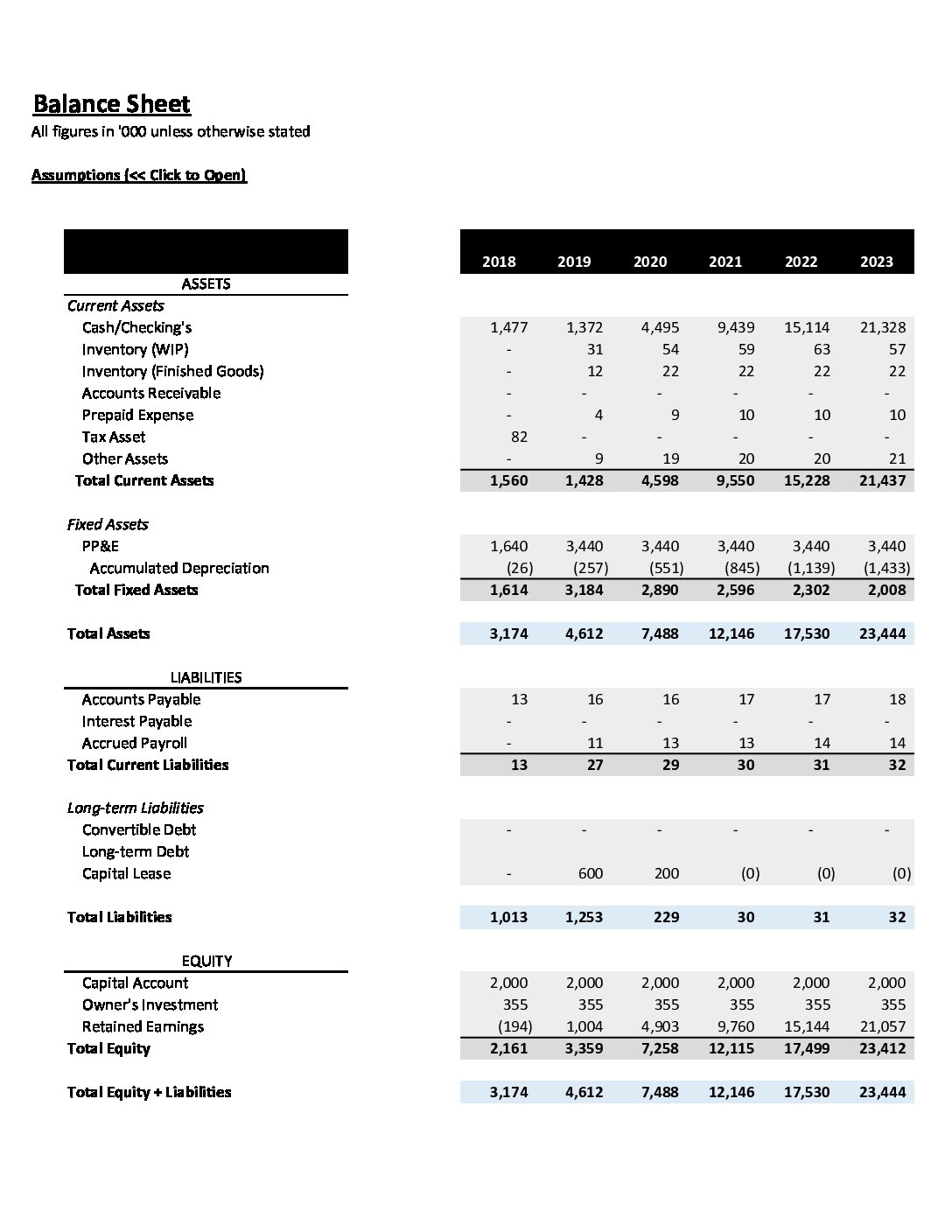

What Is A Pro Forma Balance Sheet CFO Share

Ultimate Pro Forma Template For Excel Monday Blog

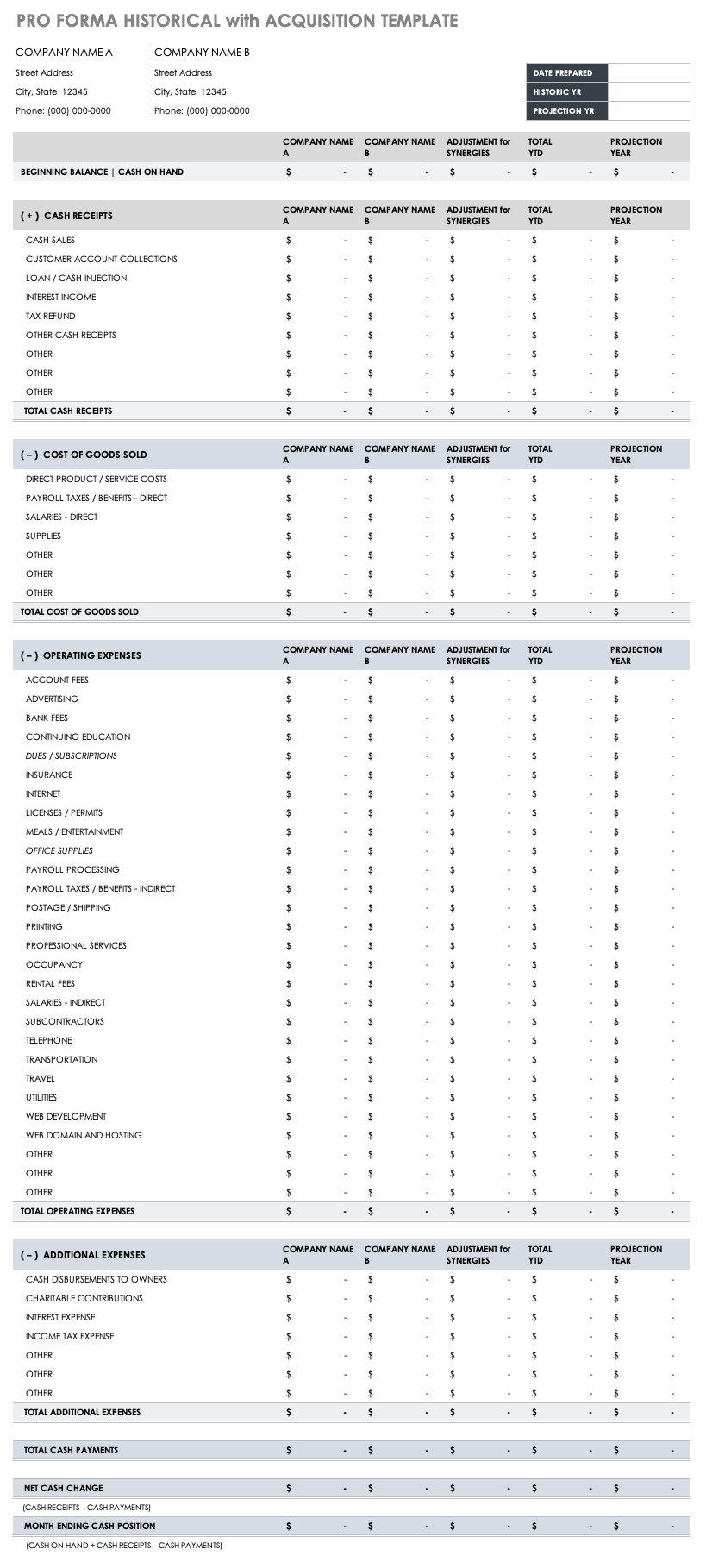

Pro Forma Financial Statements Smartsheet